From NREIOnline.com

By any measure, it’s a turbulent world out there. The European Union can’t seem to get on a path to consistent economic growth. China is experiencing a slowdown in its property markets. ISIS has emerged to further destabilize the Middle East. Russia is threatening Eastern Europe. The Ebola outbreak has yet to run its course and the U.S. stock market has been more volatile than usual of late. Yet for all the rancor, industry professionals don’t expect any of these developments to disrupt the continued recovery in the U.S. commercial real estate sector.

This may seem a peculiar claim to make in view of recent headlines and the fact that the United States’ own economic recovery has, up until now, been anemic. However, several factors have combined to protect commercial real estate from the ill effects of geopolitics.

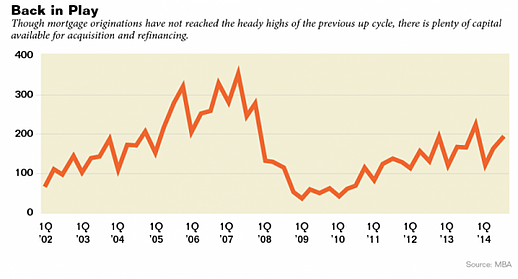

With a dearth of new construction, property fundamentals in virtually every segment of the market have improved, helped by gradually accelerating job growth. By all accounts, that recovery is still in its beginning stages, and real estate economists predict fundamentals will continue to get better for at least another year or two. Credit for new acquisitions and refinancing has been free-flowing and cheap, driving up property valuations and creating robust demand in the investment sales market. Meanwhile, the renaissance in the U.S. manufacturing sector and the resulting uptick in exports have helped keep the dollar strong, staving off the dangers of inflation.

“In the past 12 months, we’ve gone from a slow to a moderate recovery and we are still seeing momentum on the macroeconomic side,” says Calvin Schnure, vice president of research and industry information with the National Association of Real Estate Investment Trusts (NAREIT). “What was hurting us before was deleveraging, lack of consumer confidence and fiscal policy was [going] zig-zag. Those were the factors that really held the economy back, and those are gone.”

For complete article, click here.