Not long ago, the sight of shoppers swiping and typing on their smartphones at the mall was the stuff of retailers’ nightmares. The logic was that these people were doing what is known in the industry as “showrooming”—browsing the stores to touch and test a product, but ultimately buying the item online through another retailer where they could get better prices.

But smartphones and other Web-enabled gadgets are no longer thought of as a major threat of brick-and-mortar stores, and a new study by Deloitte helps illustrate why. The consulting firm surveyed thousands of shoppers and found that those using digital devices while they shop in physical stores convert—or go from browsing to buying—at a 20 percent higher rate than other shoppers. One-third of them also end up spending more in the store than they might have otherwise because of their digital interactions.

The findings offer a clear message to brick-and-mortar retailers: Gadgets aren’t the enemy. In fact, with a great mobile site or app, your customer’s smartphone could be one your most powerful tools for boosting in-store sales.

Deloitte found that shoppers are 30 percent less likely to use their mobile devices for price comparisons as they were last year. This suggests that in-store smartphone use is becoming more sophisticated: Instead of comparing prices, perhaps shoppers are reading product reviews, looking for inspiration on how to style a certain clothing item, or pulling up a map of a large store to help them find their way around. In these newer scenarios, the phone is acting as something of a digital sales associate who wants to boost sales.

The study looked at shoppers’ tech use outside of stores, too, and found that the time we spend online has an increasing influence on what we buy inside a brick-and-mortar store, helping influence some 49 percent of in-store purchases in 2014. That could mean the shopper was inspired by browsing Pinterest for ideas on how to wear a midi skirt, by reading a review of the latest smartphone, or by visiting a particular retailer’s Web site to see whether they carry mid-century modern-style end tables.

The percentage of “digitally influenced” purchases, as Deloitte calls them, is growing quickly. They went from making up 14 percent to nearly 50 percent of in-store sales in only two years.

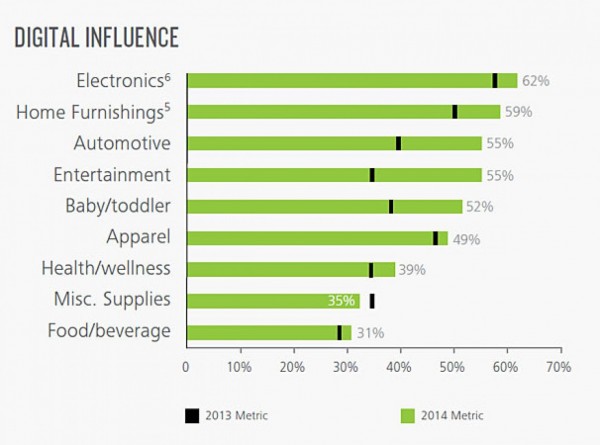

And digital influence is picking up for all types of items, as you can see in the chart below:

Deloitte’s study adds to a growing body of research that says today’s consumers are more knowledgeable than ever before. Shoppers are doing copious research before they set foot in a shop, or while they’re there. As a result, they often know exactly what they want, and they are less vulnerable to the siren call of the impulse buy.

This can present some challenges for retailers: It’s harder to boost sales by steering shoppers to buy items that aren’t on their shopping list, and it means they have to train sales associates to be able to go toe-to-toe with these ultra-prepared shoppers.

But the behavior change may not be all bad for stores. At JCPenney, for example, store traffic is down, but more shoppers who enter end up making a purchase. That likely means that even though shoppers are making fewer trips to the store, they’re still buying plenty from JCPenney. They’re just doing it in a more planned, efficient pattern.

To access original article posted on WashingtonPost.com, click here.